For Week Ending July 27, 2024

For Week Ending July 27, 2024

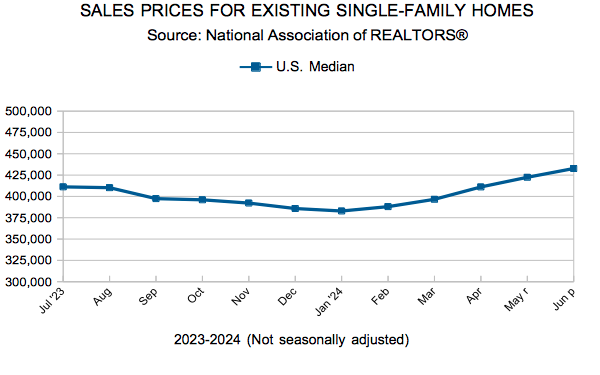

According to ATTOM’s Q2 2024 U.S. Home Affordability Report, median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide in the second quarter of the year. With sales prices on the rise, major homeownership expenses now require 35.1% of the average national wage, up from 31.9% in the first quarter, and the highest level since 2007.

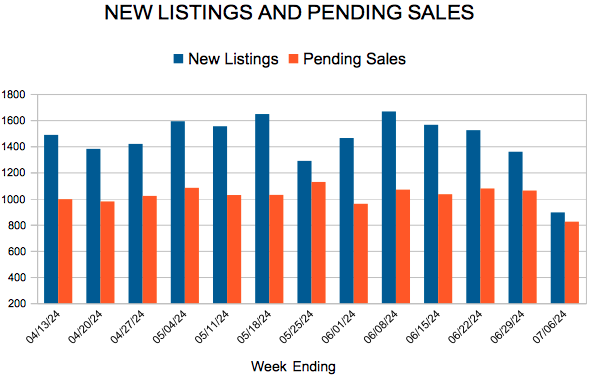

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 27:

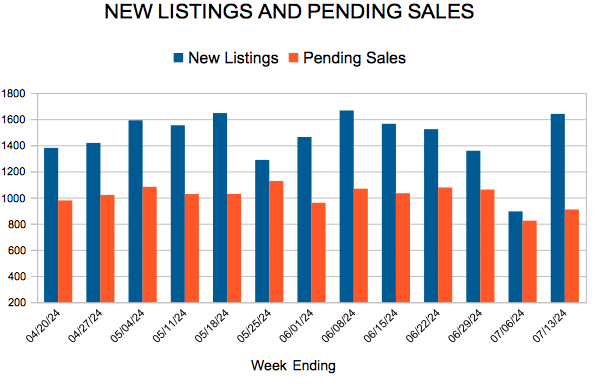

- New Listings increased 7.0% to 1,475

- Pending Sales decreased 11.6% to 959

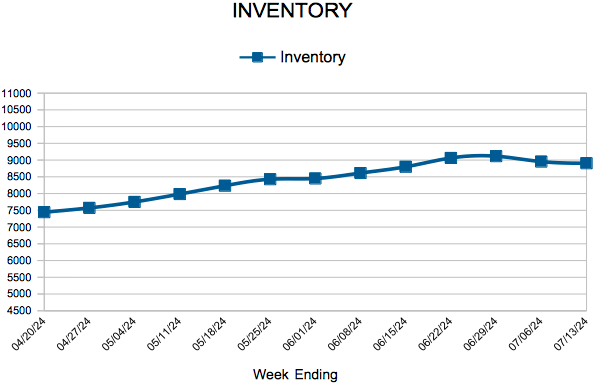

- Inventory increased 11.7% to 9,383

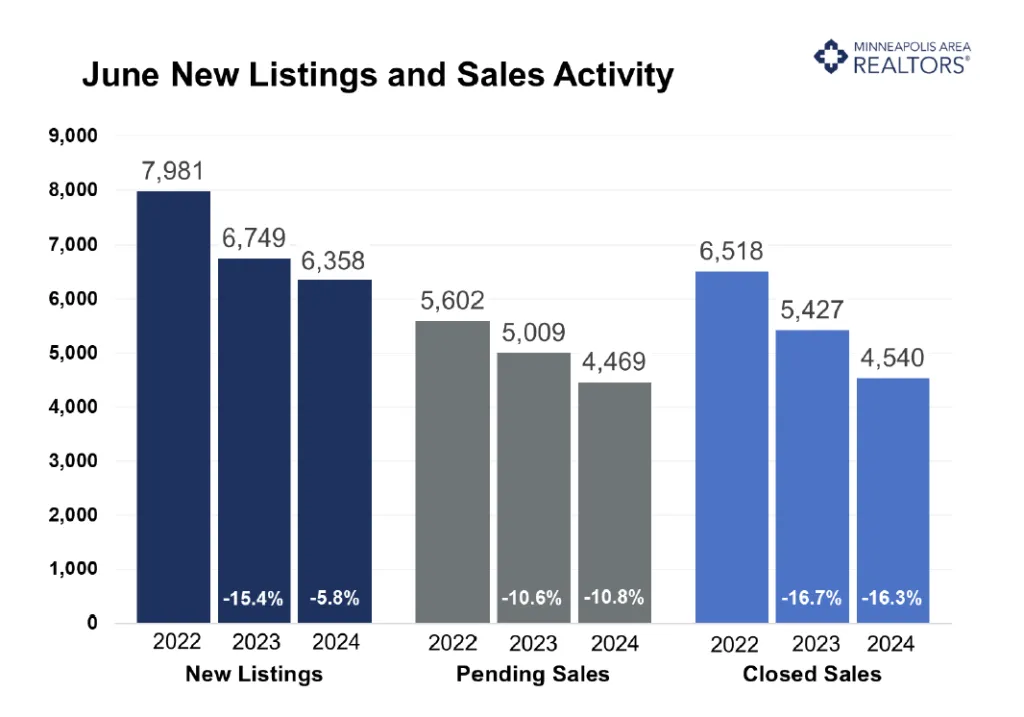

FOR THE MONTH OF JUNE:

- Median Sales Price increased 1.8% to $390,000

- Days on Market increased 12.9% to 35

- Percent of Original List Price Received decreased 1.2% to 100.1%

- Months Supply of Homes For Sale increased 19.0% to 2.5

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.