For Week Ending February 26, 2022

For Week Ending February 26, 2022

Nationally, pending home sales decreased 5.7% as of last measure, marking the third consecutive month of declines according to the National Association of REALTORS®. With housing supply at a record low, buyers are finding fewer and fewer homes for sale, while rising mortgage rates and increased housing costs have priced out marginal buyers. Inventory levels are expected to improve gradually as the weather warms; in the meantime, economists say buyers should expect a challenging spring market.

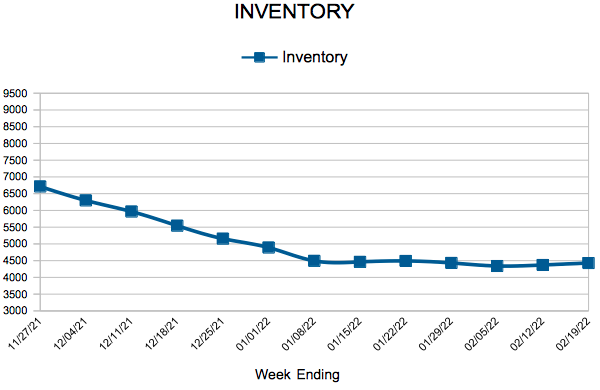

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 26:

- New Listings decreased 12.7% to 1,104

- Pending Sales decreased 15.1% to 964

- Inventory decreased 16.9% to 4,469

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 10.6% to $333,000

- Days on Market decreased 2.4% to 41

- Percent of Original List Price Received increased 0.1% to 99.6%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 19, 2022

For Week Ending February 19, 2022

Median rental prices have increased by double-digits for eight consecutive months, rising 19.8% year-over-year. While home prices continue to climb, according to Realtor.com’s January Rental Report, buying a starter home is more affordable than renting a similar sized apartment in more than half of the nation’s largest metropolitan areas. That’s because, nationally, rent growth is rising faster than home prices, with economists expecting rental prices to outpace listing price growth in 2022.

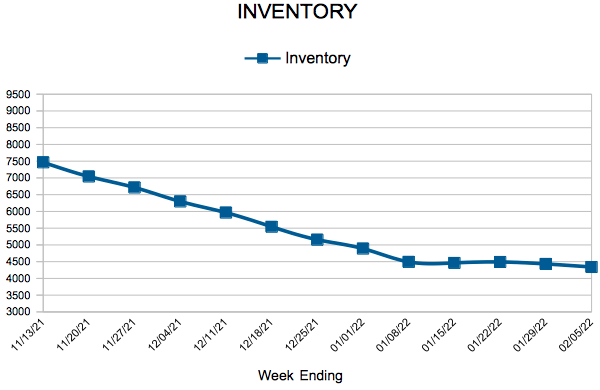

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 19:

- New Listings decreased 3.0% to 1,057

- Pending Sales decreased 11.0% to 913

- Inventory decreased 19.2% to 4,429

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 10.6% to $333,000

- Days on Market decreased 2.4% to 41

- Percent of Original List Price Received increased 0.1% to 99.6%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 12, 2022

For Week Ending February 12, 2022

Freddie Mac reports the 30-year fixed-rate mortgage averaged 3.69% the week ending February 10, up 14 basis points from a week earlier and a full point higher than the record low of 2.65% at the beginning of 2021. Rising interest rates and increasing housing prices continue to impact affordability, and buyer sentiment is softening as a result, with the mortgage application Purchase Index falling 7% from the same week last year, according to the Mortgage Bankers Association.

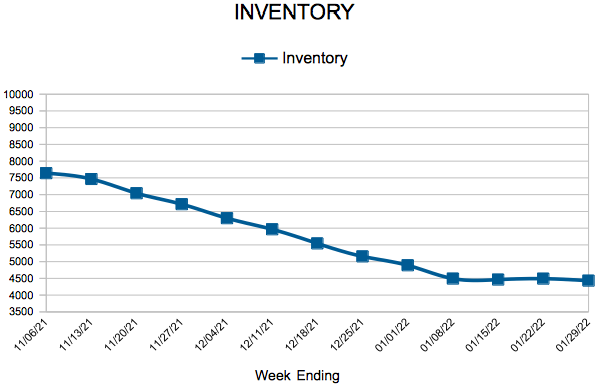

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 12:

- New Listings decreased 12.1% to 1,040

- Pending Sales decreased 9.1% to 910

- Inventory decreased 20.0% to 4,371

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 10.6% to $332,950

- Days on Market decreased 2.4% to 41

- Percent of Original List Price Received increased 0.1% to 99.6%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 5, 2022

For Week Ending February 5, 2022

Despite falling temperatures and a surge in COVID-19 cases across the country, the U.S. real estate market remains active, with homes selling in record time due to robust buyer demand and a shortage of housing options. With inventory down 28.4% compared to a year ago, the average home spent just 61 days on the market in January, a 14% drop from last year and the fastest pace of any January on record, according to Realtor.com’s monthly housing report.

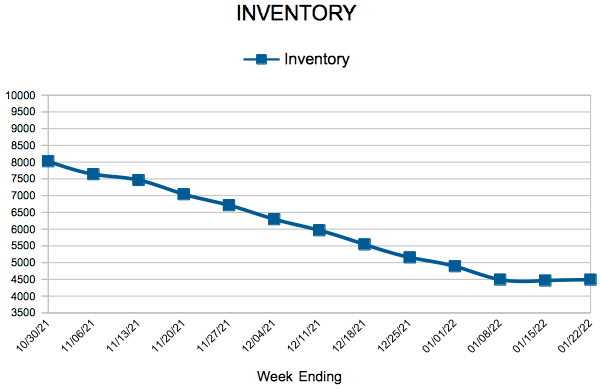

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 5:

- New Listings decreased 15.3% to 1,018

- Pending Sales decreased 19.1% to 883

- Inventory decreased 21.2% to 4,341

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 8.0% to $331,420

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 18.2% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending January 29, 2022

For Week Ending January 29, 2022

Home seller profits increased in more than 90% of housing markets last year, the highest level since 2008, according to ATTOM Data Solutions’ Year-End 2021 U.S. Home Sales Report. On average, sellers saw a profit of $94,092 on a typical median-priced home in 2021, an increase of 45% from 2020 and up 71% from 2019. Sellers saw a 45.3% return on investment compared to the original purchase price, with the highest profits found among sellers in western states.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 29:

- New Listings decreased 17.8% to 850

- Pending Sales decreased 12.8% to 826

- Inventory decreased 21.2% to 4,432

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,270

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 18.2% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 27

- 28

- 29

- 30

- 31

- …

- 37

- Next Page »