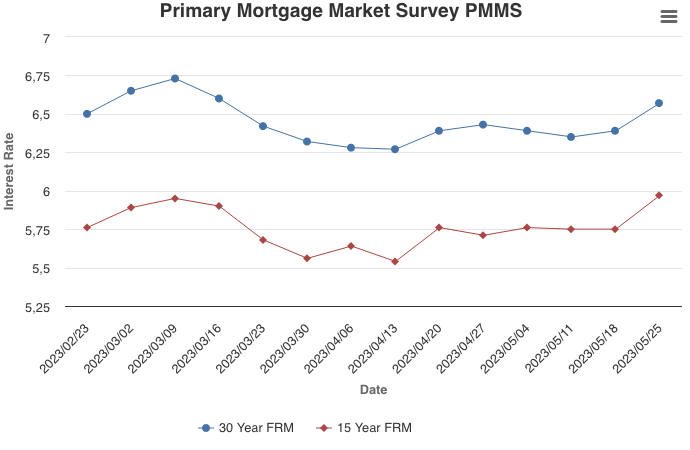

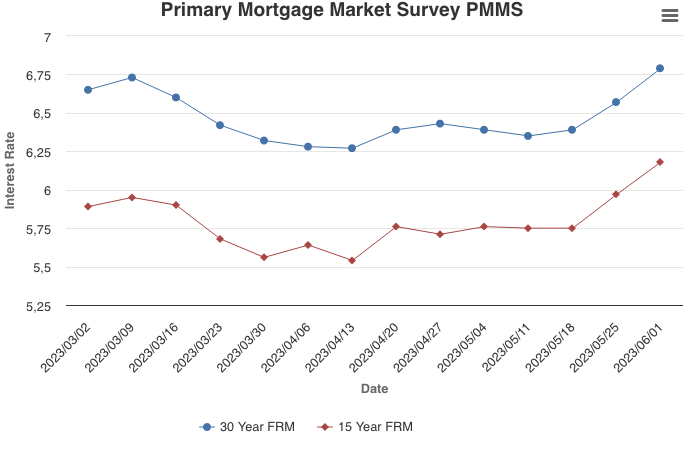

June 1, 2023

Mortgage rates jumped this week, as a buoyant economy has prompted the market to price-in the likelihood of another Federal Reserve rate hike. Although there has been a steady flow of purchase demand around rates in the low to mid six percent range, that demand is likely to weaken as rates approach seven percent.

Information provided by Freddie Mac.

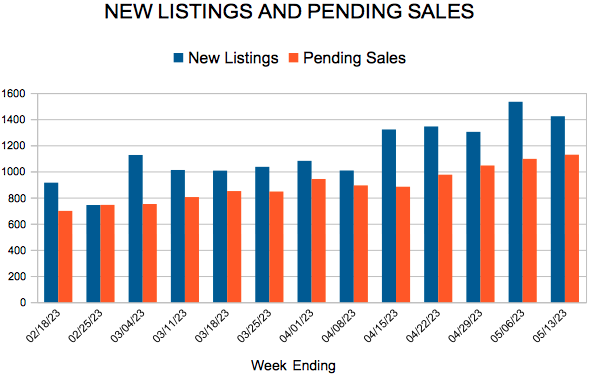

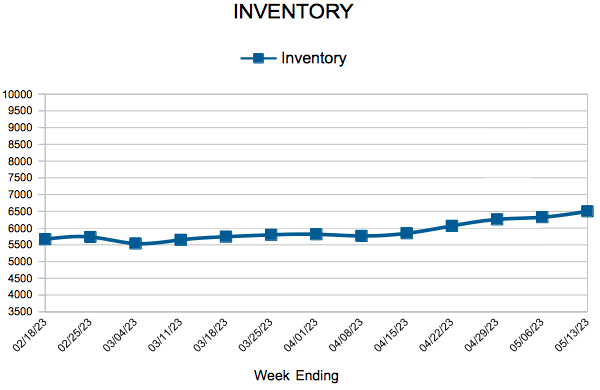

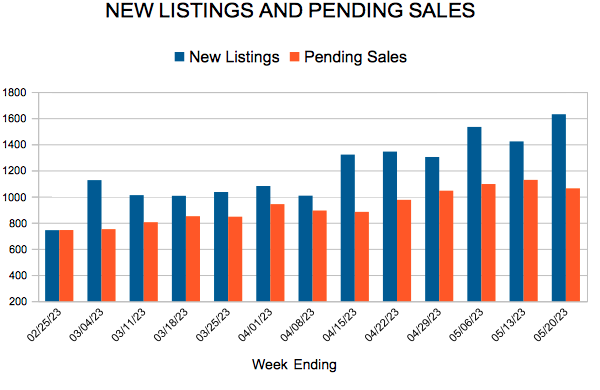

For Week Ending May 20, 2023

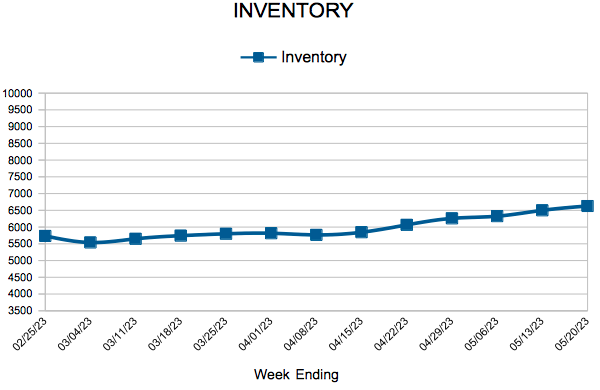

For Week Ending May 20, 2023