Inventory

Weekly Market Report

For Week Ending August 26, 2023

For Week Ending August 26, 2023

U.S. home equity recently hit a 4-year high, with nearly half of all mortgage borrowers considered equity rich—having a loan to value ratio of 50% or lower—in the second quarter of this year. According to ATTOM’s Q2 2023 U.S. Home Equity and Underwater Report, 49% of mortgaged residential homes were equity rich, up from 47% in the first quarter of the year, with quarterly increases found in 45 states. The highest levels of equity-rich mortgaged properties continue to be found in the West, with six of the top 10 states in the second quarter located in that region.

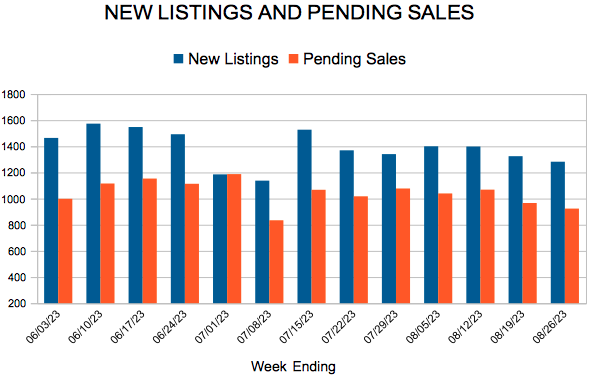

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 26:

- New Listings increased at 1,282

- Pending Sales decreased 9.2% to 923

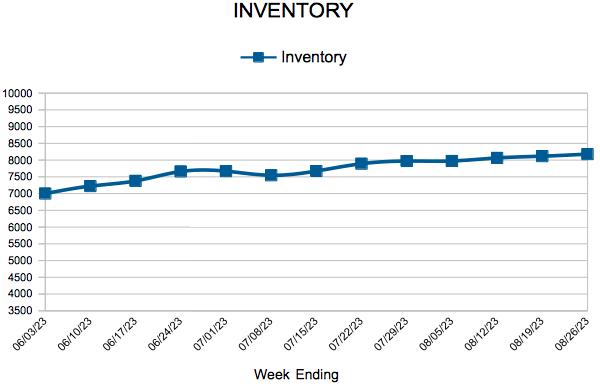

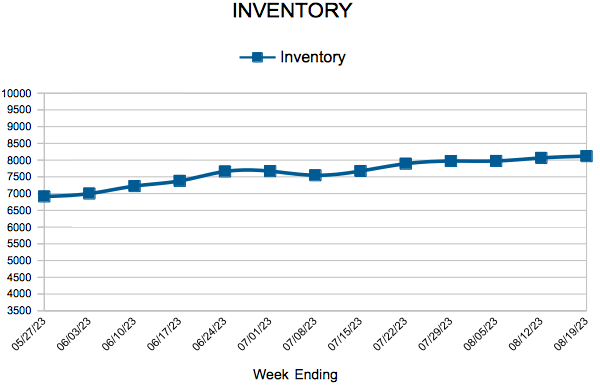

- Inventory decreased 12.7% to 8,178

FOR THE MONTH OF JULY:

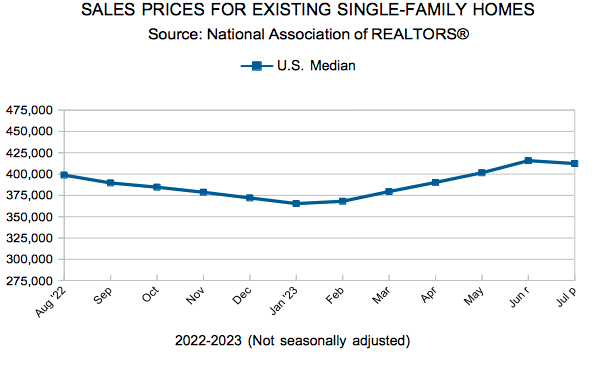

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

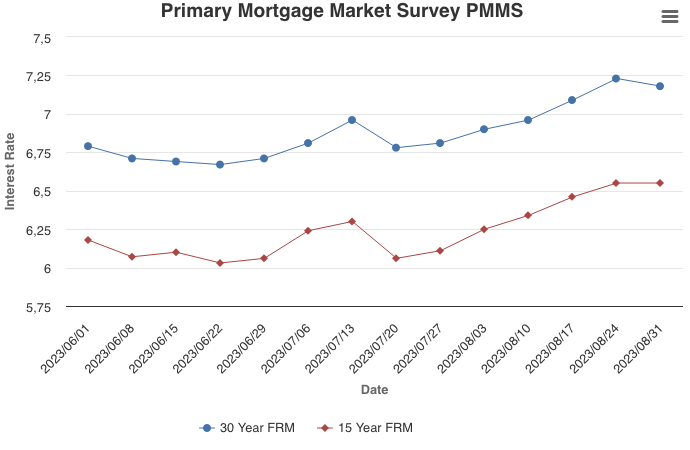

The 30-Year Fixed-Rate Mortgage Decreases

August 31, 2023

Mortgage rates leveled off this week but remain elevated. Despite continued high rates, low inventory is keeping house prices steady. Recent volatility makes it difficult to forecast where rates will go next, but it might be easier to gauge as the Federal Reserve determines their next steps regarding interest rate hikes in September.

Information provided by Freddie Mac.

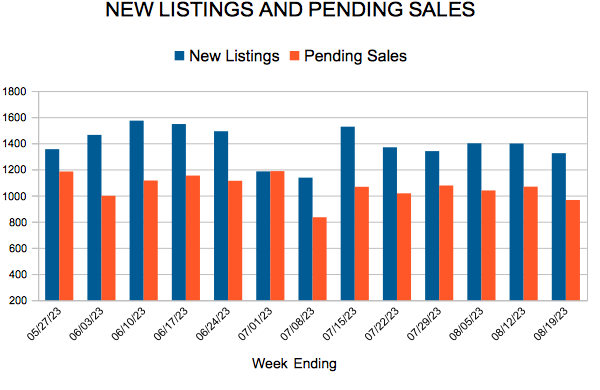

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 19, 2023

For Week Ending August 19, 2023

International buyers of U.S. homes purchased 14.2% fewer homes from April 2022 to March 2023 compared to the same 12-month period a year before, according to the latest data from the National Association of REALTORS® (NAR). Foreign buyers purchased 84,600 homes, marking the fewest number of properties purchased annually by foreign buyers since 2009, when NAR began tracking this data. Although sales were down, home prices have continued to rise, with the median existing-home sales price among international buyers hitting $396,400, the highest ever recorded by NAR.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 19:

- New Listings decreased 3.1% to 1,324

- Pending Sales decreased 15.0% to 966

- Inventory decreased 14.0% to 8,117

FOR THE MONTH OF JULY:

- Median Sales Price increased at $375,250

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 10.5% to 2.1

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

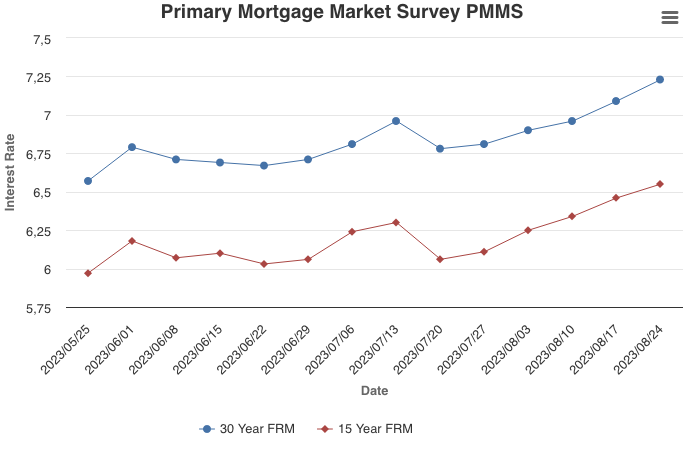

Mortgage Rates Continue to Surge

August 24, 2023

This week, the 30-year fixed-rate mortgage reached its highest level since 2001 and indications of ongoing economic strength will likely continue to keep upward pressure on rates in the short-term. As rates remain high and supply of unsold homes woefully low, incoming data shows that existing homes sales continue to fall. However, there are slightly more new homes available, and sales of these new homes continue to rise, helping provide modest relief to the unyielding housing inventory predicament.

Information provided by Freddie Mac.

July Monthly Skinny Video

Existing Home Sales

- « Previous Page

- 1

- …

- 52

- 53

- 54

- 55

- 56

- …

- 105

- Next Page »