For Week Ending July 10, 2021

For Week Ending July 10, 2021

As sales prices surge, housing affordability continues to decline, despite historically low interest rates. According to the National Association of REALTORS® Housing Affordability Index, the median family income increased by only 1.2% in May, while the monthly mortgage payment rose to $1,204, a 20% gain compared to a year ago. Homeowners are allocating more of their income toward their mortgage, putting additional strain on consumers’ pocketbooks amid rising inflation, as the Consumer Price Index jumped 5.4% in the year through June, according to the Labor Department, the largest year-over-year gain since August 2008.

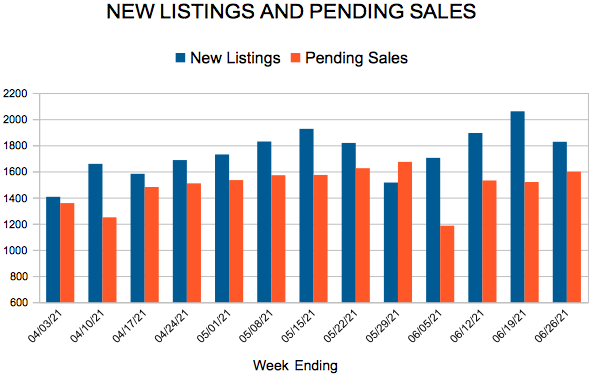

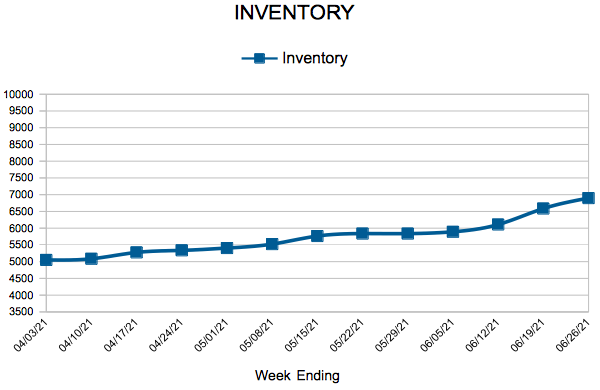

In the Twin Cities region, for the week ending July 10:

- New Listings decreased 7.8% to 1,751

- Pending Sales decreased 30.1% to 1,103

- Inventory decreased 32.6% to 6,709

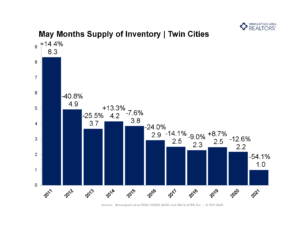

For the month of June:

- Median Sales Price increased 14.8% to $350,000

- Days on Market decreased 52.4% to 20

- Percent of Original List Price Received increased 4.5% to 104.1%

- Months Supply of Homes For Sale decreased 42.9% to 1.2

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.