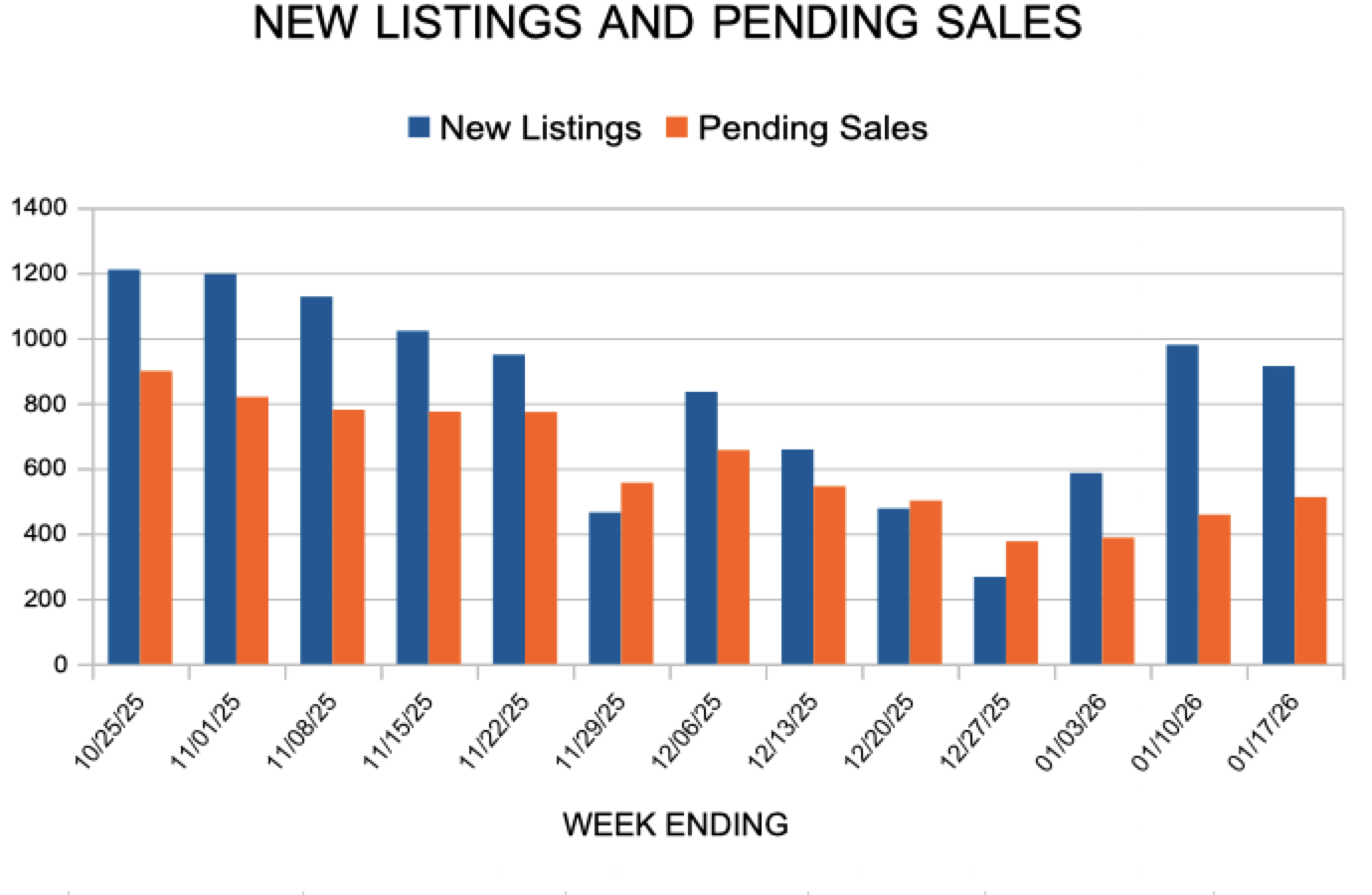

New Listings and Pending Sales

New Listings and Pending Sales

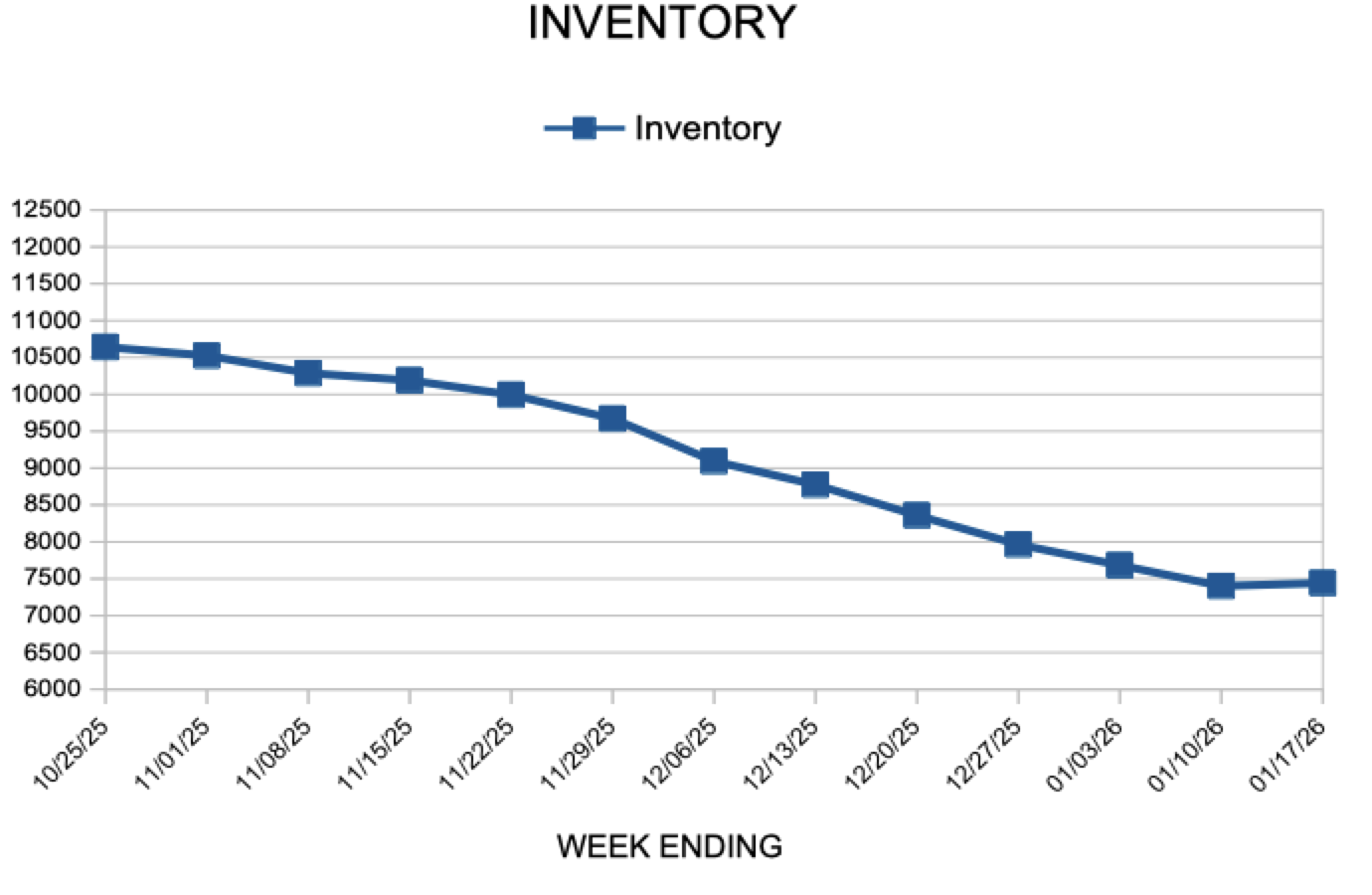

Inventory

Inventory

Inventory

Weekly Market Report

For Week Ending January 17, 2026

For Week Ending January 17, 2026

The average 30-year fixed mortgage rate fell to 6.06% the week ending January 15, 2026, the lowest level since September 2022, according to Freddie Mac. The Mortgage Bankers Association noted that lower rates have coincided with a rise in purchase and refinance applications, as borrowers respond to recent improvements in affordability.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 17:

- New Listings decreased 3.6% to 914

- Pending Sales decreased 15.1% to 512

- Inventory decreased 1.3% to 7,441

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 3.6% to 58

- Percent of Original List Price Received decreased 0.2% to 96.8%

- Months Supply of Homes For Sale decreased 5.0% to 1.9

All comparisons are to 2025

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Remain the Lowest in Three Years

January 22, 2026

With the economy improving and the average 30-year fixed-rate mortgage nearly a percentage point lower than last year, more homebuyers are entering the market. Buyers always should shop around for the best rate, as multiple quotes can potentially save them thousands.

- The 30-year fixed-rate mortgage averaged 6.09% as of January 22, 2026, up from last week when it averaged 6.06%. A year ago at this time, the 30-year FRM averaged 6.96%.

- The 15-year fixed-rate mortgage averaged 5.44%, up from last week when it averaged 5.38%. A year ago at this time, the 15-year FRM averaged 6.16%.

Information provided by Freddie Mac.

Mortgage Rates Remain the Lowest in Three Years

January 22, 2026

With the economy improving and the average 30-year fixed-rate mortgage nearly a percentage point lower than last year, more homebuyers are entering the market. Buyers always should shop around for the best rate, as multiple quotes can potentially save them thousands.

- The 30-year fixed-rate mortgage averaged 6.09% as of January 22, 2026, up from last week when it averaged 6.06%. A year ago at this time, the 30-year FRM averaged 6.96%.

- The 15-year fixed-rate mortgage averaged 5.44%, up from last week when it averaged 5.38%. A year ago at this time, the 15-year FRM averaged 6.16%.

Information provided by Freddie Mac.

Mortgage Rates Remain the Lowest in Three Years

January 22, 2026

With the economy improving and the average 30-year fixed-rate mortgage nearly a percentage point lower than last year, more homebuyers are entering the market. Buyers always should shop around for the best rate, as multiple quotes can potentially save them thousands.

- The 30-year fixed-rate mortgage averaged 6.09% as of January 22, 2026, up from last week when it averaged 6.06%. A year ago at this time, the 30-year FRM averaged 6.96%.

- The 15-year fixed-rate mortgage averaged 5.44%, up from last week when it averaged 5.38%. A year ago at this time, the 15-year FRM averaged 6.16%.

Information provided by Freddie Mac.

- 1

- 2

- 3

- …

- 110

- Next Page »