June 15, 2023

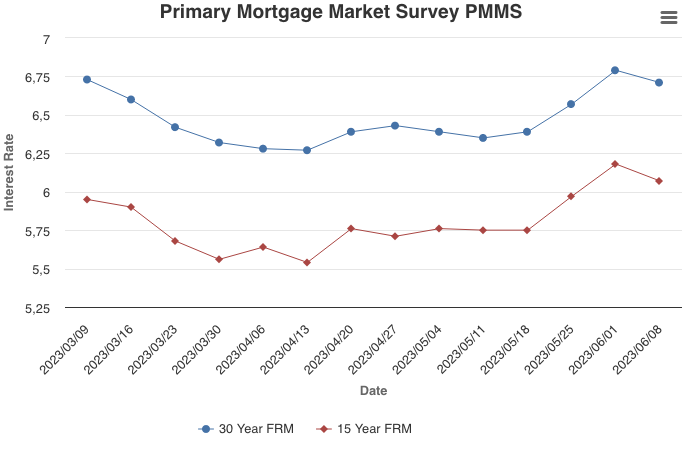

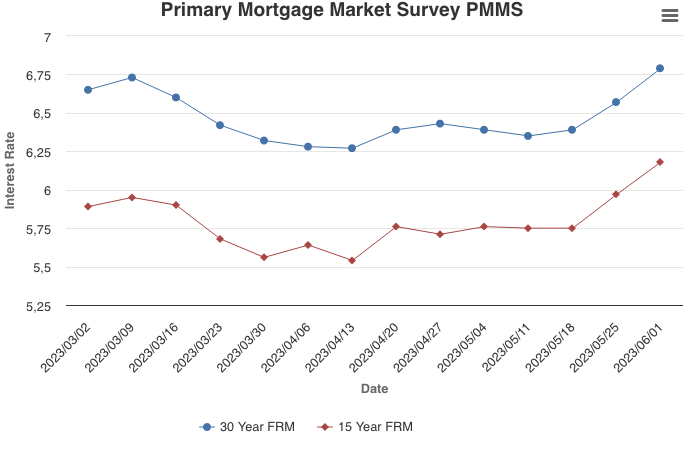

Mortgage rates decreased slightly this week in anticipation of the pause in rate hikes by the Federal Reserve. As inflation continues to decelerate, economic growth is slowing and the tightening cycle of monetary policy is reaching its apex, which means mortgage rates are expected to decrease later this year and into next.

Information provided by Freddie Mac.

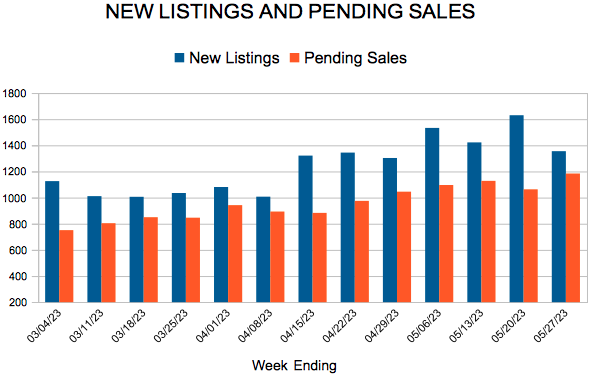

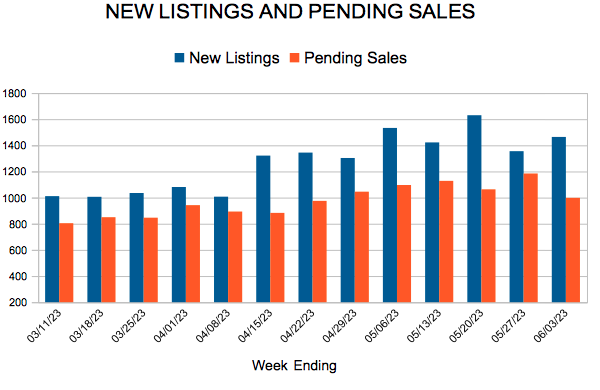

For Week Ending June 3, 2023

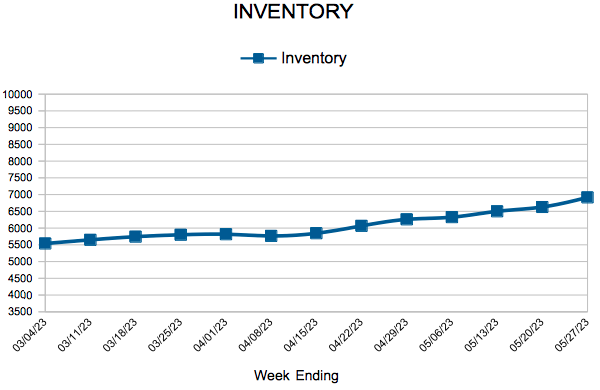

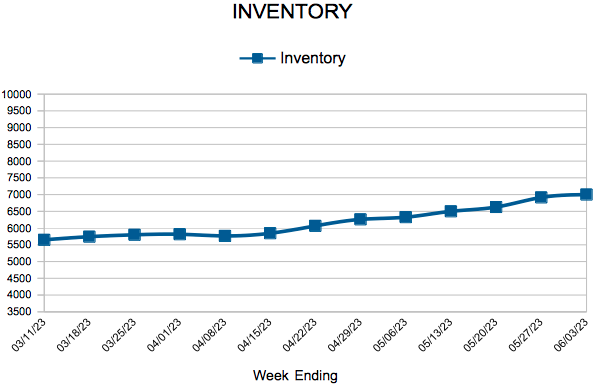

For Week Ending June 3, 2023