For Week Ending May 7, 2022

For Week Ending May 7, 2022

Demand for adjustable-rate mortgages (ARMs) is rising, as buyers look to mitigate higher monthly payments caused by record-high sales prices and surging mortgage interest rates. Although less popular than fixed rate mortgages, ARMs offer introductory rates lower than rates from conventional mortgages and currently represent 11% of mortgage loans, up from 3% at the beginning of the year, according to the Mortgage Bankers Association.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 7:

- New Listings decreased 5.7% to 1,808

- Pending Sales decreased 11.6% to 1,406

- Inventory decreased 5.2% to 5,811

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

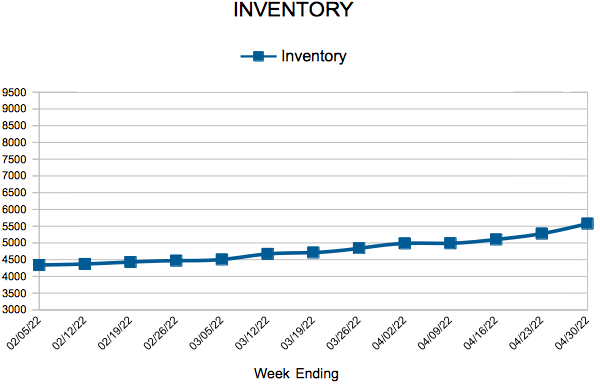

Inventory

Weekly Market Report

For Week Ending April 30, 2022

For Week Ending April 30, 2022

70% of metropolitan areas saw the median existing-home sales price rise by double digits annually in the first quarter of 2022, up from 66% of metro areas in the previous quarter, according to the National Association of REALTORS® (NAR) latest quarterly report. In 27 U.S. markets, buyers needed at least $100,000 annual income to afford a 10% down payment, with first time buyers typically spending 28.4% of monthly income on mortgage payments, exceeding the 25% threshold NAR considers unaffordable.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 30:

- New Listings decreased 4.8% to 1,731

- Pending Sales decreased 9.3% to 1,424

- Inventory decreased 6.9% to 5,576

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,077

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

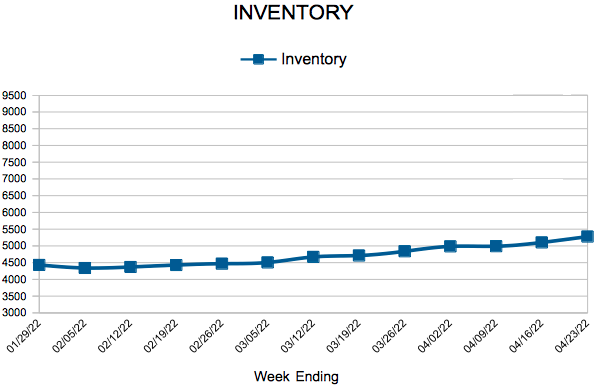

Inventory

Weekly Market Report

For Week Ending April 23, 2022

For Week Ending April 23, 2022

Home sales prices continue to reach new heights, and record gains in equity are motivating an increasing number of sellers to put their homes up for sale, according to Homelight’s 2022 Buyer and Seller Insights Report. With multiple offers common in many markets, many homeowners have high expectations when it comes to the sale of their home. More than 40% of sellers believe their home will sell for more than asking price, and about half of those surveyed expect to retain 30% or more of the sale price as a profit.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 23:

- New Listings decreased 0.6% to 1,759

- Pending Sales decreased 22.8% to 1,176

- Inventory decreased 10.9% to 5,278

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,000

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

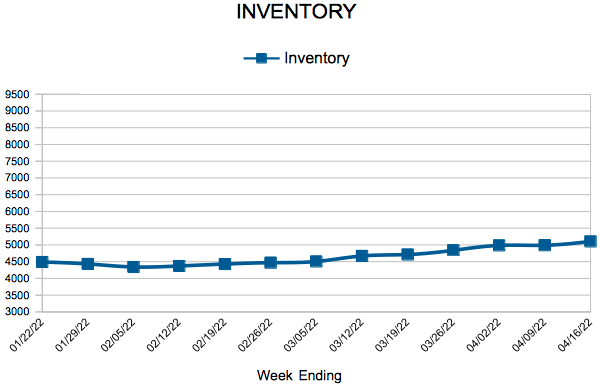

Inventory

Weekly Market Report

For Week Ending April 16, 2022

For Week Ending April 16, 2022

Builder confidence softened for the fourth straight month in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index, as escalating sales prices, higher construction costs, and increasing mortgage rates continue to impact housing affordability. With the average sales price of a new home upwards of $500,000 as of last measure, builders report sales traffic and sales conditions have fallen to their lowest points since last summer.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 16:

- New Listings decreased 12.8% to 1,454

- Pending Sales decreased 6.3% to 1,406

- Inventory decreased 13.2% to 5,103

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,000

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

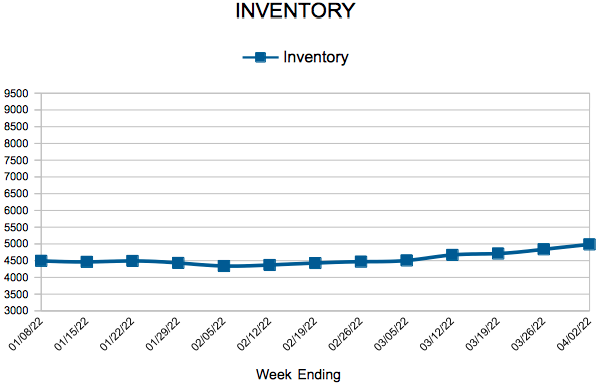

Inventory

Weekly Market Report

For Week Ending April 9, 2022

For Week Ending April 9, 2022

Rising mortgage interest rates are taking a toll on borrowers, having increased more than 1.5 points since the beginning of the year, the fastest three-month rate increase since 1994, according to Freddie Mac. The recent surge in mortgage rates has caused a decline in mortgage demand, with the Mortgage Bankers Association (MBA) reporting the Refinance Index is down 62% compared to a year ago, while the unadjusted Purchase Index is 6% lower compared to this time last year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 9:

- New Listings decreased 13.8% to 1,503

- Pending Sales increased 3.3% to 1,326

- Inventory decreased 12.1% to 4,990

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $353,950

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 25

- 26

- 27

- 28

- 29

- …

- 37

- Next Page »