New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending May 6, 2023

For Week Ending May 6, 2023

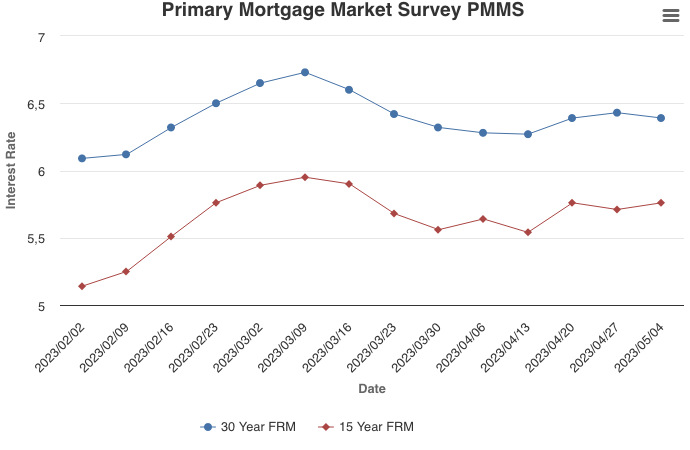

Mortgage interest rates fell slightly following the Federal Reserve’s recent decision to raise its benchmark short-term interest rate by a quarter percentage point this month, its 10th interest rate hike since March 2022. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.39% the week ending 5/4/23, up from 5.27% a year ago. Many economists expect mortgage interest rates will continue to soften over the year due to cooling inflation.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 6:

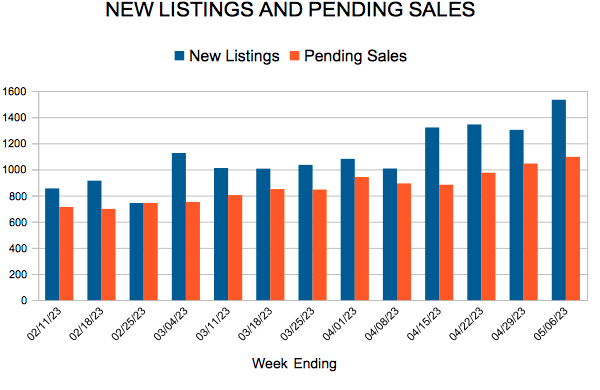

- New Listings decreased 18.2% to 1,533

- Pending Sales decreased 23.4% to 1,096

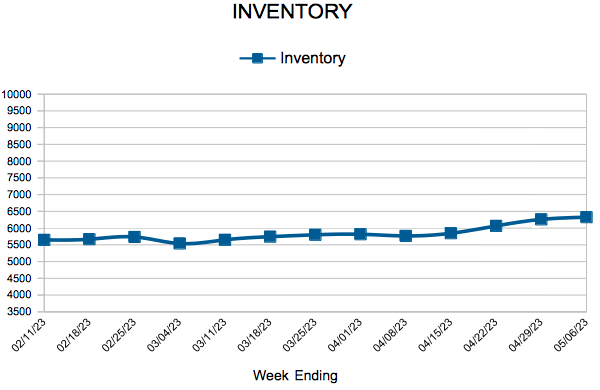

- Inventory increased at 6,325

FOR THE MONTH OF MARCH:

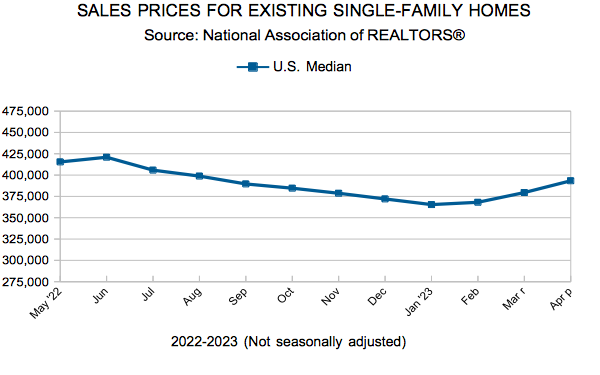

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

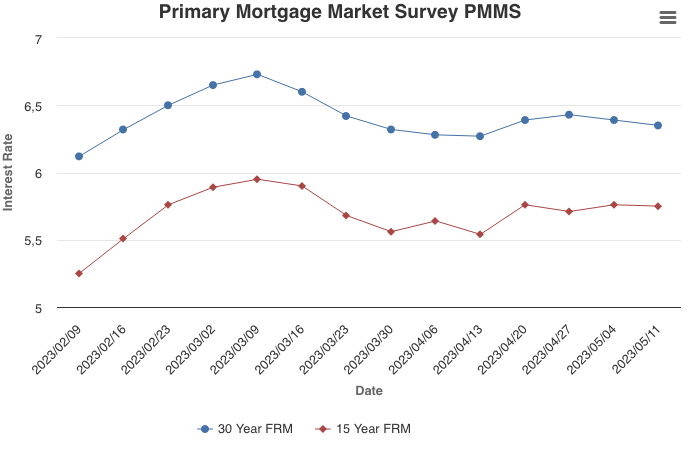

Mortgage Rates Inch Down

May 11, 2023

May 11, 2023

This week’s decrease continues a recent sideways trend in mortgage rates, which is a welcome departure from the record increases of last year. While inflation remains elevated, its rate of growth has moderated and is expected to decelerate over the remainder of 2023. This should bode well for the trajectory of mortgage rates over the long-term.

Information provided by Freddie Mac.

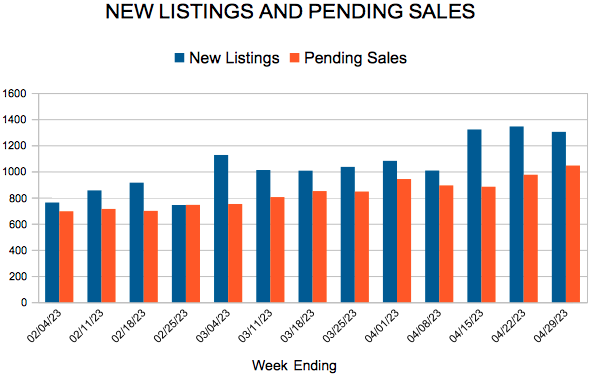

New Listings and Pending Sales

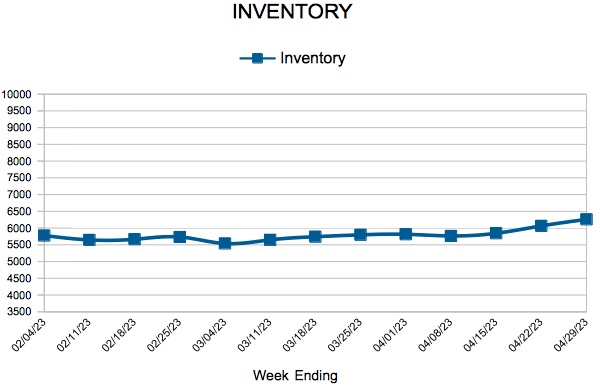

Inventory

Weekly Market Report

For Week Ending April 29, 2023

For Week Ending April 29, 2023

Homeownership remains a key driver to building wealth. According to a recent report from the National Association of REALTORS®, middle-class homeowners saw the median value of their homes appreciate $122,070, or 68%, over the last decade. Meanwhile, lower income homeowners saw a 75% gain in the median value of their homes, with an increase of $98,910 in wealth solely from home price appreciation, while upper income homeowners saw an increase of $150,810 in wealth from their homes in the last 10 years.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 29:

- New Listings decreased 27.3% to 1,303

- Pending Sales decreased 26.2% to 1,045

- Inventory increased 2.7% to 6,259

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Tick Down

May 4, 2023

This week, mortgage rates inched down slightly amid recent volatility in the banking sector and commentary from the Federal Reserve on its policy outlook. Spring is typically the busiest season for the residential housing market and, despite rates hovering in the mid-six percent range, this year is no different. Interested homebuyers are acclimating to the current rate environment, but the lack of inventory remains a primary obstacle to affordability.

Information provided by Freddie Mac.

March Monthly Skinny Video

- « Previous Page

- 1

- …

- 34

- 35

- 36

- 37

- 38

- …

- 80

- Next Page »