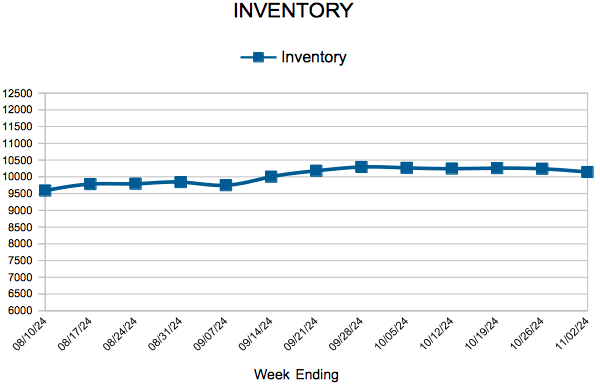

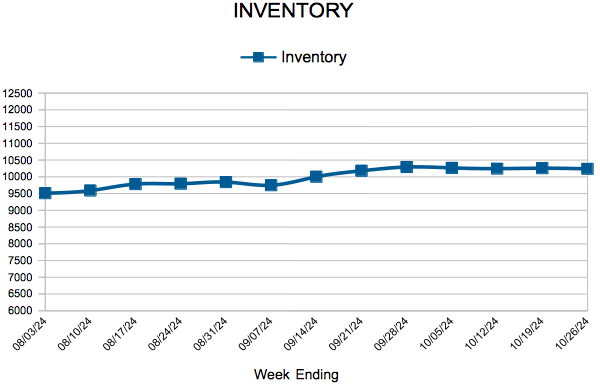

Inventory

Weekly Market Report

For Week Ending November 2, 2024

For Week Ending November 2, 2024

U.S. housing starts edged down 0.5% from the previous month to a seasonally adjusted annual rate of 1.35 million units, according to the U.S. Census Bureau. Single-family housing starts rose 2.7% to a seasonally adjusted annual rate of 1.03 million units, a five-month high, while multi-family housing starts declined 4.5% to 317,000 units. Year to date, single-family construction is up 10.1%.

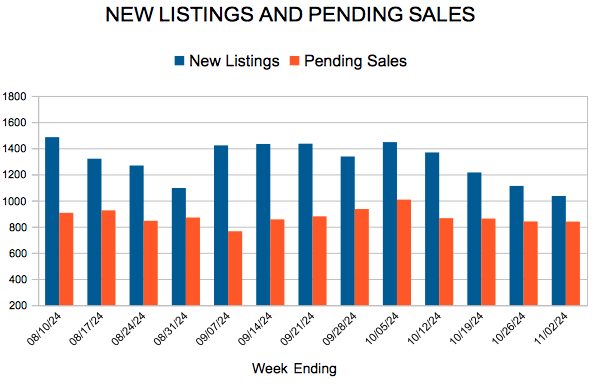

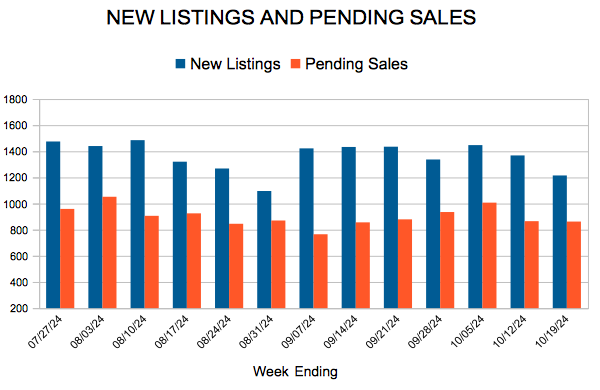

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 2:

- New Listings decreased 3.1% to 1,035

- Pending Sales increased 7.8% to 839

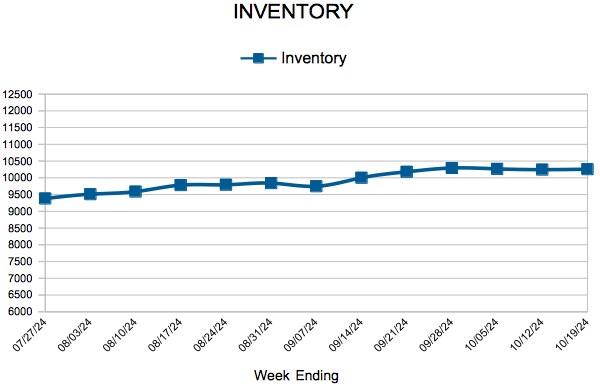

- Inventory increased 9.7% to 10,144

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $379,950

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

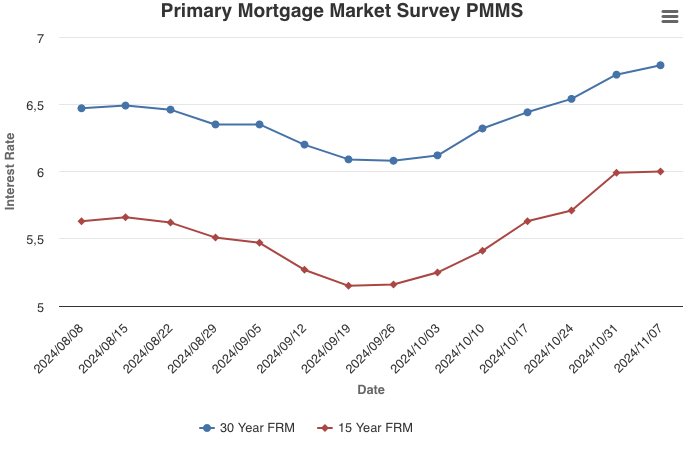

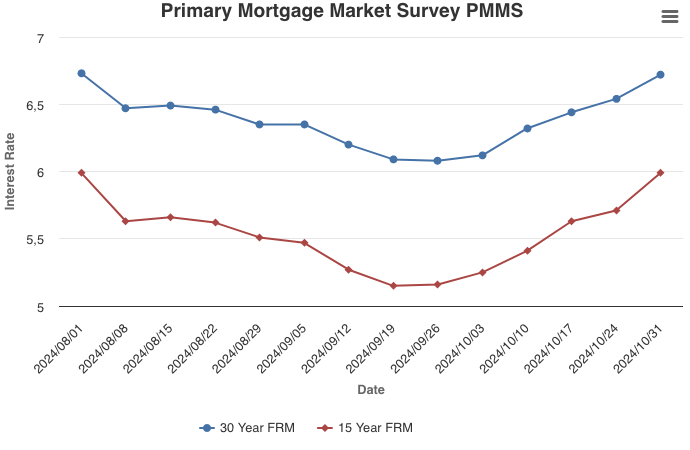

Mortgage Rates Continue to Rise

November 7, 2024

Mortgage rates continued to inch up this week, reaching 6.79 percent. It is clear purchase demand is very sensitive to mortgage rates in the current market environment. As soon as rates began to rise in early October, purchase applications fell and over the last month have declined 10 percent.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 26, 2024

For Week Ending October 26, 2024

Millennials—people ages 28 to 43—make up the largest share of homebuyers nationwide, according to the National Association of REALTORS® 2024 Home Buyers and Sellers Generational Trends Report. Millennials comprised 38% of buyers in transactions that occurred between July 2022 and June 2023, up from 28% the previous 12-month period. Meanwhile, baby boomers, who held the top spot among homebuyers last year at 39%, came in second place, accounting for 31% of all purchase transactions.

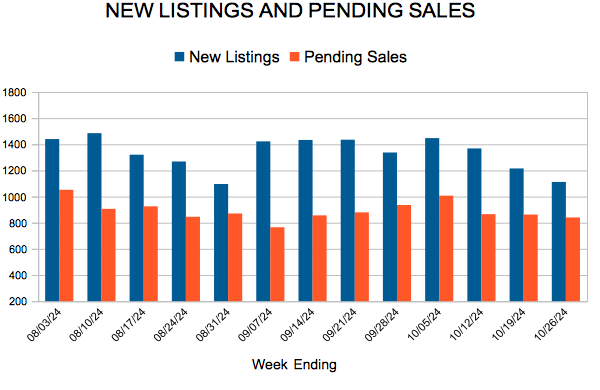

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 26:

- New Listings increased 10.2% to 1,112

- Pending Sales increased 20.0% to 840

- Inventory increased 9.9% to 10,239

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $380,000

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Increase for the Fifth Consecutive Week

October 31, 2024

Increasing for the fifth consecutive week, mortgage rates reached their highest level since the beginning of August. With several potential inflection points happening over the next week, including the jobs report, the 2024 election, and the Federal Reserve interest rate decision, we can expect mortgage rates to remain volatile. Although uncertainty will remain, it does appear mortgage rates are cresting, and are not expected to reach the highs seen earlier this year.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 84

- Next Page »