January 11, 2024

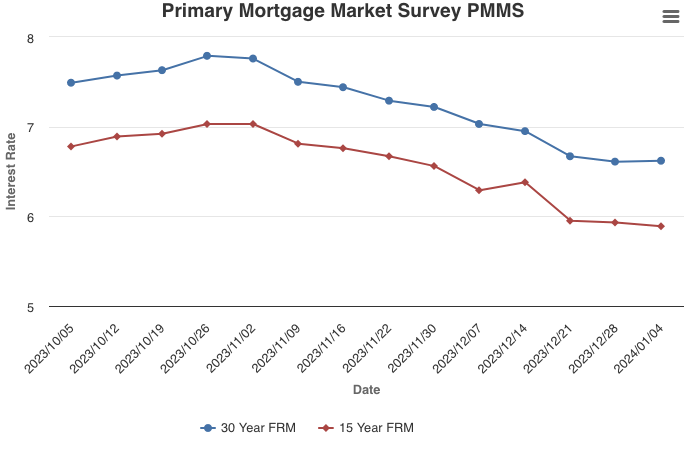

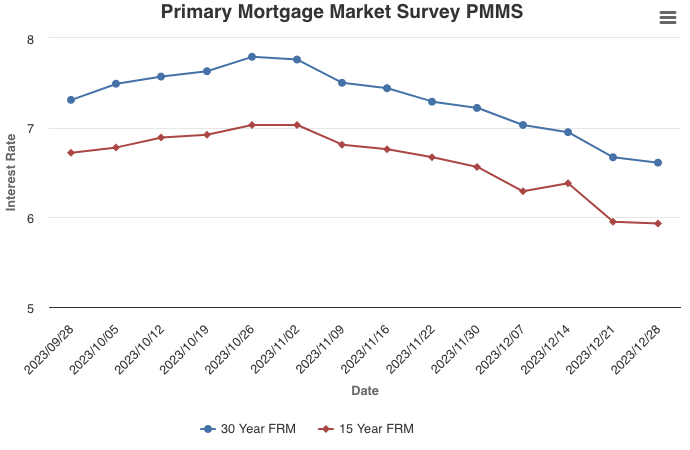

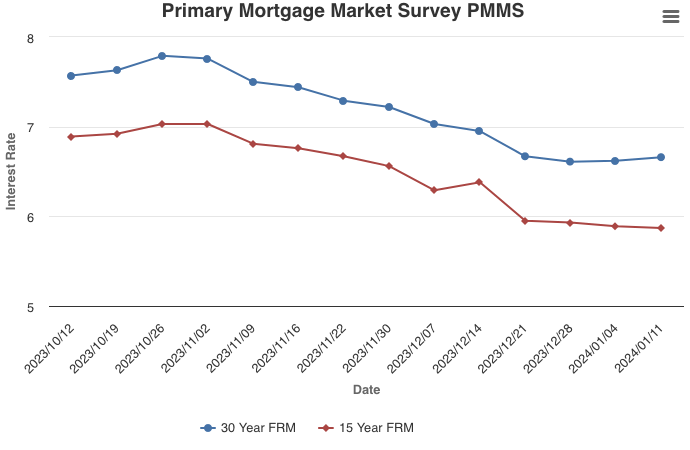

Mortgage rates have not moved materially over the last three weeks and remain in the mid-six percent range, which has marginally increased homebuyer demand. Even this slight uptick in demand, combined with inventory that remains tight, continues to cause prices to rise faster than incomes, meaning affordability remains a major headwind for buyers. Potential homebuyers should look closely at existing state and local resources, such as down payment assistance programs, which can considerably help defray closing costs.

Information provided by Freddie Mac.

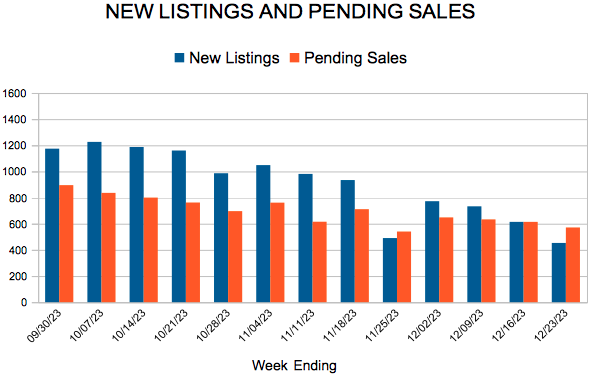

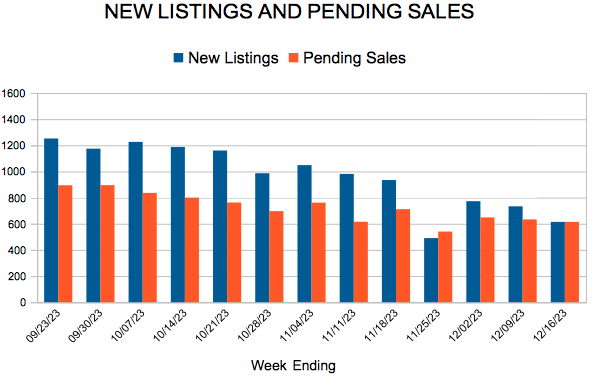

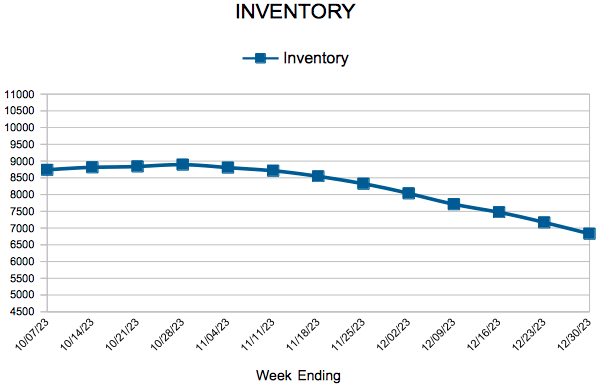

For Week Ending December 30, 2023

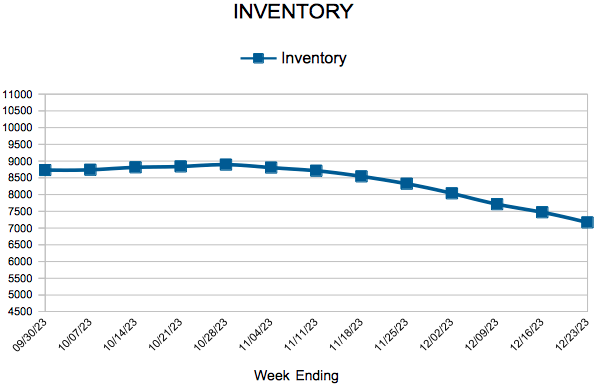

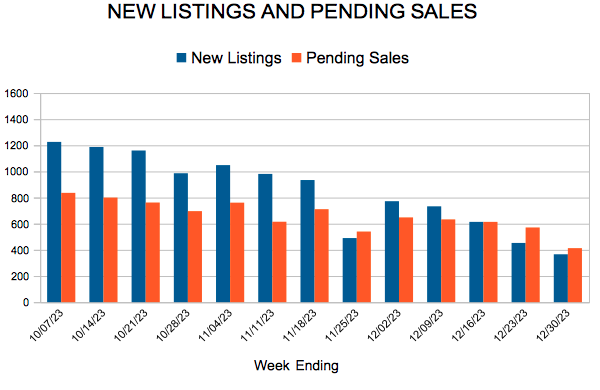

For Week Ending December 30, 2023