Home prices are still on the increase and that is not likely to change during the summer months. The Median Sales Price increased 16.1 percent to $342,500 for the month.

Demand for Homes Continues to Increase, Tightening Market Inventory

(June 16, 2021) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyer activity in May was up 15.7 percent compared to last year, a twelfth-straight increase in month-over-month pending sales. Demand from buyers in the Twin Cities metro continues to out-pace the supply of new listings into the market.

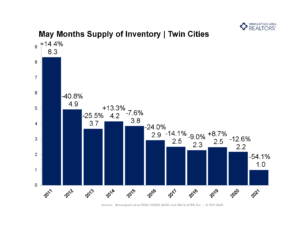

Seller activity in May grew slightly in a year, up 2.6 percent from 2020, but dropped by 19.9 percent compared to 2019, our most recent pre-COVID year. The relative imbalance in performance between buyers and sellers has led to a strong seller’s market. Currently, the Twin Cities has 1.0 month’s supply of inventory. Typically, four to six months is considered a balanced market.

“Half of all listings in the Twin Cities have an accepted offer within a week,” according to Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “As the summer season begins to build, buyers need to continue to be prepared to make firm decisions and strong offers on a home.”

In May, homes spent a median seven days on market, which is down 56.3 percent from last year. The quick shelf life of listings is particularly impressive given that the median price of a home in the Twin Cities metro rose to $342,500, a 16.1 percent increase from last May. The 30-Year Fixed Rate Mortgage Average in the United States did not exceed 3.0 percent, giving buyers the ability to stretch their dollar further.

“Recent showing activity shows that prospective home buyers shifted their interests to more expensive homes,” said Todd Walker, President of Minneapolis Area REALTORS®. “Two years ago, listings priced under $200,000 saw the largest share of showing activity. This year listings around $250,000 have seen the greatest share of activity.”

Activity varies by area, price point and property type. Sales of single-family homes were up 42.1 percent in Minneapolis and 16.7 percent in St. Paul, suggesting demand remains strong in the core cities. Condos continue to lead sales growth by property type. Across the 16-county Twin Cities region condo sales rose 98.3 percent. Sales of previously owned homes rose 18.3 percent while new construction rose 5.5 percent.

May 2021 by the numbers compared to a year ago

- Sellers listed 7,576 properties on the market, a 2.6 percent increase from last May

- Buyers signed 6,834 purchase agreements, up 15.7 percent (5,543 closed sales, up 15.4 percent)

- Inventory levels fell 46.9 percent to 5,687 units

- Month’s Supply of Inventory was down 54.5 percent to 1.0 month (4-6 months is balanced)

- The Median Sales Price rose 16.1 percent to $342,500

- Days on Market decreased 41.5 percent to 24 days, on average (median of 7 days, down 56.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales were up 10.7 percent; condo sales rose 98.3 percent; townhome sales increased 13.6 percent

- Traditional sales rose 16.6 percent; foreclosure sales were down 35.8 percent; short sales fell 63.6 percent

- Previously owned sales were up 18.3 percent; new construction sales dropped 5.5 percent

Weekly Market Report

For Week Ending June 5, 2021

For Week Ending June 5, 2021

Fannie Mae’s new refinancing program, RefiNow™, which offers qualifying homeowners with a Fannie Mae-owned mortgage new options for refinancing their loans, officially starts on June 5th. Borrowers at or below 80% of the area’s median income may qualify for this new program, which can lower interest rates and reduce monthly payments by $50 or more. Homeowners can learn more about qualifications and their options by contacting their lender or visiting KnowYourOptions.com.

In the Twin Cities region, for the week ending June 5:

- New Listings decreased 3.5% to 1,704

- Pending Sales decreased 21.3% to 1,185

- Inventory decreased 44.3% to 5,892

For the month of April:

- Median Sales Price increased 10.2% to $336,250

- Days on Market decreased 34.0% to 31

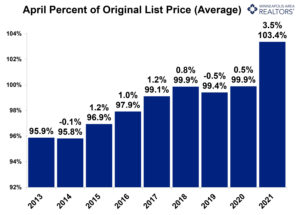

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 47.6% to 1.1

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 29, 2021

For Week Ending May 29, 2021

According to Black Knight, mortgage loan delinquency rates are continuing to decline, with the national delinquency rate falling to 4.66% in its April survey from 5.02% in March. While the continued decline of delinquency rates is a positive sign, nearly 1.8 million first-lien mortgages remain seriously delinquent, which is 1.3 million more than before the pandemic.

In the Twin Cities region, for the week ending May 29:

- New Listings increased 2.0% to 1,515

- Pending Sales increased 30.6% to 1,673

- Inventory decreased 45.4% to 5,837

For the month of April:

- Median Sales Price increased 10.2% to $336,250

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 47.6% to 1.1

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 22, 2021

For Week Ending May 22, 2021

A new analysis from Realtor.com® found that 20% of home sales nationwide in the first two months of this year were purchased in cash, up about 5% from a year ago. The substantial increase in cash buyers can be partially attributed to the competitiveness of the housing market, where a cash offer can help a buyer’s offer stand out from competing offers. Meanwhile, for buyers that do need to finance their purchase, mortgage rates on a 30-year fixed-rate mortgage averaged just 3% last week.

In the Twin Cities region, for the week ending May 22:

- New Listings increased 1.1% to 1,818

- Pending Sales increased 7.5% to 1,625

- Inventory decreased 45.1% to 5,838

For the month of April:

- Median Sales Price increased 10.4% to $336,845

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 52.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 15, 2021

For Week Ending May 15, 2021

Despite elevated demand for housing, construction of new homes fell in April, with the U.S. Department of Housing and Urban Development and the U.S. Census Bureau reporting a 9.5% decrease in housing starts from the previous month. Rising building costs continue to hinder affordability and inventory for many homebuyers, although shortages in labor, issues with the U.S. supply chain, and lasting impact from late winter storms have also contributed to the decline in new construction activity, putting some projects on pause for the time being.

In the Twin Cities region, for the week ending May 15:

- New Listings increased 13.8% to 1,926

- Pending Sales increased 13.5% to 1,573

- Inventory decreased 45.8% to 5,765

For the month of April:

- Median Sales Price increased 10.2% to $336,250

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 52.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

April Monthly Skinny Video

April was another strong month for home sales. The busy spring market continues to see many multiple offer situations driving sales prices above asking price.

Supply Rebounds from 2020 Levels While Demand Continues to Rise

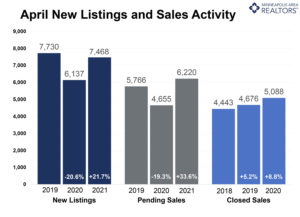

(May 17, 2021) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, seller activity in April was up 21.7 percent compared to last year, when new listings dipped partly due to COVID-19. The number of homes that were put on the market in April is comparable to pre-pandemic levels in 2019 and 2018.

The median price of a home in the 16-county Twin Cities metro rose to $337,000, a 10.5 percent increase from last April and a new record high for the region. Even so, half of homes go under contract within 8 days of listing, the fastest time in at least 14 years. This is a clear indication that the metro is still in need of a greater housing supply to keep up with rising demand.

“It’s promising to see improvements in housing supply, but it’s clear that we aren’t out of the woods just yet,” said Todd Walker, President of Minneapolis Area REALTORS®. “In time, more potential sellers will be encouraged to list, enticed by rising prices and more inventory. In the meantime, developers need incentives to expand new inventory, particularly in affordable price ranges.”

Although supply rebounded to that of pre-pandemic levels in April, the increase in demand was even greater. Pending sales are up 34.0 percent from April of last year and exceed 2019 numbers by 8.2 percent. With 5,619 homes for sale, the Twin Cities currently has 1.0 month’s supply of inventory. Typically, 4-6 months is considered a balanced market.

“Buyers still benefit from record low mortgage rates at around 3.0 percent,” according to Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “Although a limited supply is driving prices higher, low rates are a strong incentive to offer a competitive bid for a home.”

Activity varies by area, price point and property type. Sales of single-family homes were up 32.0 percent in Minneapolis and 14.8 percent in St. Paul, suggesting demand remains strong in the core cities. Across the 16-county Twin Cities region condo sales rose 50.6 percent, outpacing single-family and townhomes. Sales on previously owned homes rose 10.3 percent while new construction rose 2.0 percent. Luxury property sales ($1M+) are up 180.6 percent from last April, 90.6 percent from April 2019.

April 2021 by the numbers compared to a year ago

- Sellers listed 7,468 properties on the market, a 21.7 percent increase from last April

- Buyers signed 6,220 purchase agreements, up 33.6 percent (5,088 closed sales, up 8.8 percent)

- Inventory levels fell 45.8 percent to 5,619 units

- Month’s Supply of Inventory was down 52.4 percent to 1.0 month (4-6 months is balanced)

- The Median Sales Price rose 10.5 percent to $337,000

- Days on Market decreased 34.0 percent to 31 days, on average (median of 8 days, down 52.9 percent)

- Changes in Sales activity varied by market segment

- Single family sales were up 3.6 percent; condo sales rose 50.6 percent; townhome sales increased 17.0 percent

- Traditional sales rose 10.1 percent; foreclosure sales were down 44.1 percent; short sales fell 69.2 percent

- Previously owned sales were up 10.3 percent; new construction sales climbed 2.0 percent

Weekly Market Report

For Week Ending May 8, 2021

For Week Ending May 8, 2021

The Mortgage Bankers Association’s latest National Delinquency Survey found the seasonally adjusted delinquency rate of one-to-four unit residential properties decreased to 6.38 percent of all loans outstanding in Q1 2021, which is 35 basis points lower than Q4 2020 but still 202 basis points higher than the same time last year. The COVID-19 induced delinquency rate peaked in Q2 2020 at 8.22 percent and over the last three quarters has experienced the quickest decline in the history of the survey. Although delinquencies remain elevated, the continued declines are encouraging and are expected to continue.

In the Twin Cities region, for the week ending May 8:

- New Listings increased 0.7% to 1,829

- Pending Sales increased 24.5% to 1,571

- Inventory decreased 47.0% to 5,524

For the month of April:

- Median Sales Price increased 10.5% to $337,000

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.5% to 103.4%

- Months Supply of Homes For Sale decreased 52.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 1, 2021

For Week Ending May 1, 2021

The National Association of Home Builders’ latest Housing Trends Report found that in Q1 2021, 16% of American adults were looking to purchase a home in the next 12 months, up from 10% from a year ago and now at the highest level since Q1 2018. The Millennial generation saw the largest change in expectations year over year, with 32% planning to buy in the next 12 months, double the levels seen in Q1 2020.

In the Twin Cities region, for the week ending May 1:

- New Listings increased 10.8% to 1,730

- Pending Sales increased 25.5% to 1,534

- Inventory decreased 47.8% to 5,406

For the month of March:

- Median Sales Price increased 10.5% to $328,231

- Days on Market decreased 36.1% to 39

- Percent of Original List Price Received increased 2.7% to 101.9%

- Months Supply of Homes For Sale decreased 47.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 80

- 81

- 82

- 83

- 84

- 85

- Next Page »