For Week Ending October 5, 2024

For Week Ending October 5, 2024

According to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers, buyers moved a median distance of 20 miles to their new home last year, down from 50 miles the year before, and closer to the previous norm of 15 miles. Among those buyers surveyed, 60% said the quality of the neighborhood was the most important factor in deciding where to move, while proximity to friends and family and housing affordability came in at 45% and 39%, respectively.

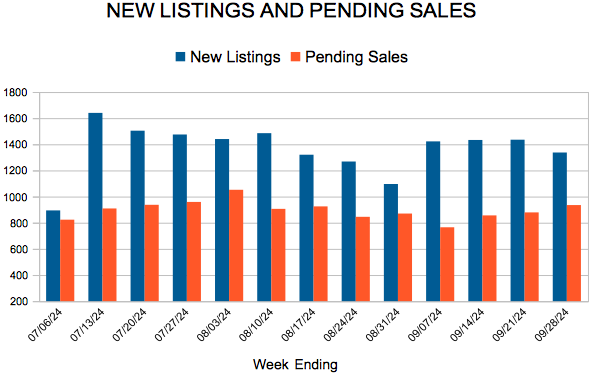

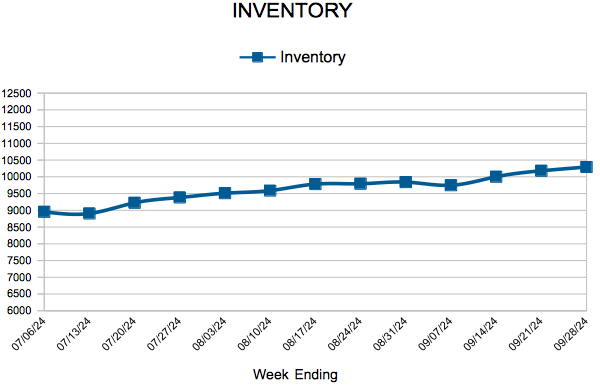

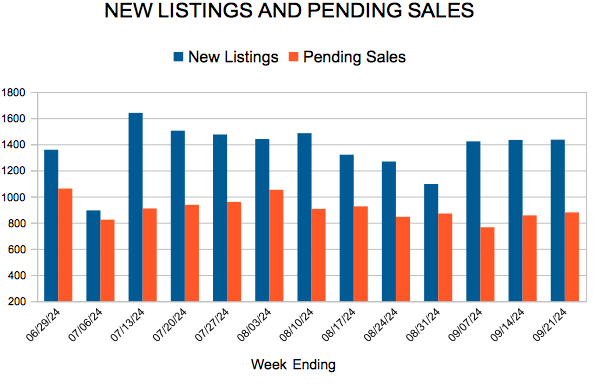

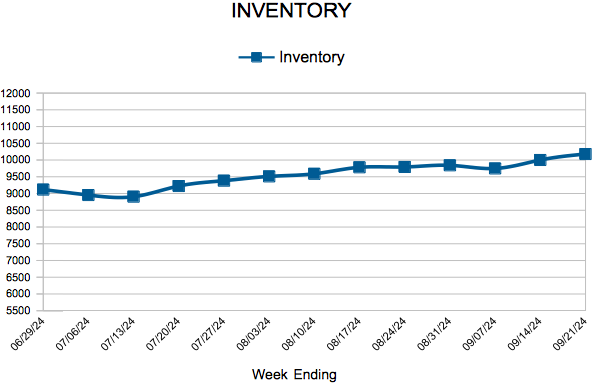

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 5:

- New Listings increased 14.9% to 1,447

- Pending Sales increased 19.5% to 1,007

- Inventory increased 12.0% to 10,267

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.