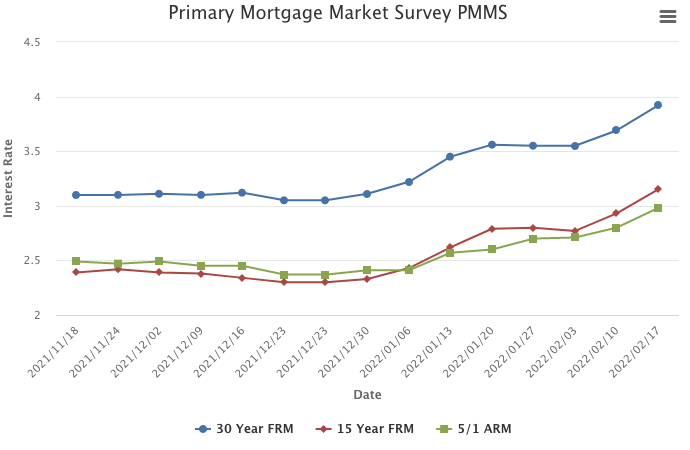

For many buyers, 2022 marks a new opportunity to make their home purchase dreams a reality. But it won’t be without its challenges.

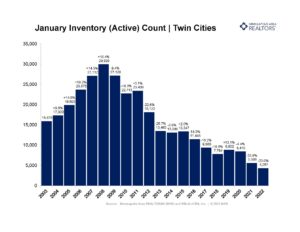

Inventory of existing homes was at 910,000 at the start of the new year, the lowest level recorded since 1999, and competition remains fierce.

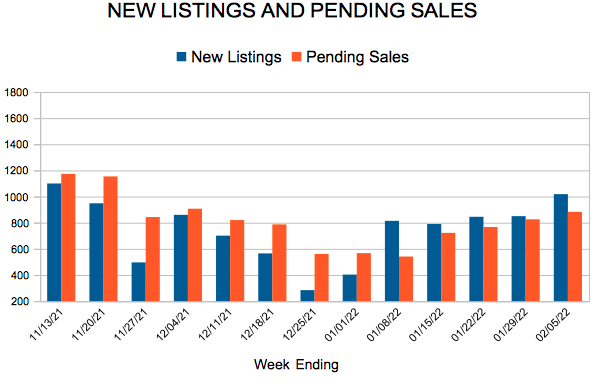

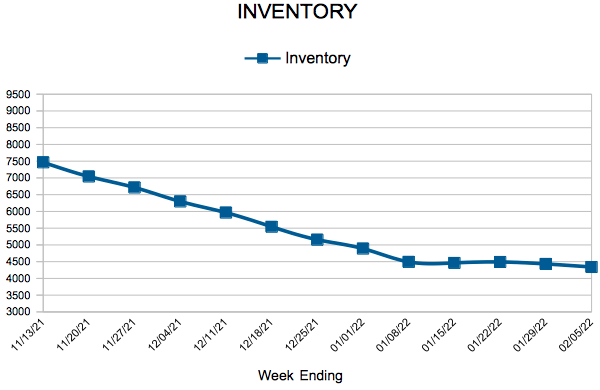

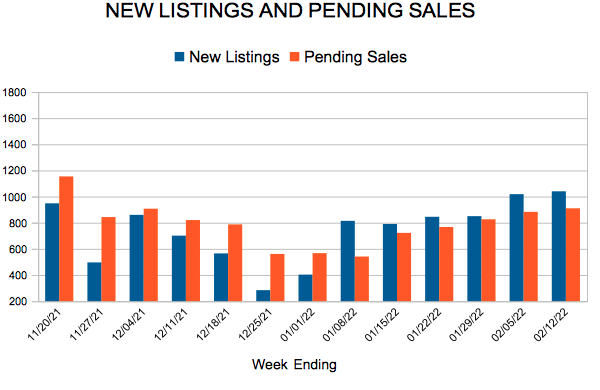

Pending Sales decreased 13.0 percent from January 2021 to 3,122 for the month. Closed Sales decreased 16.7 percent from January 2021 to 2,810 for the month. Inventory levels market-wide decreased 30.1 percent to 3,894 units.

For Week Ending February 12, 2022

For Week Ending February 12, 2022