January 5, 2023

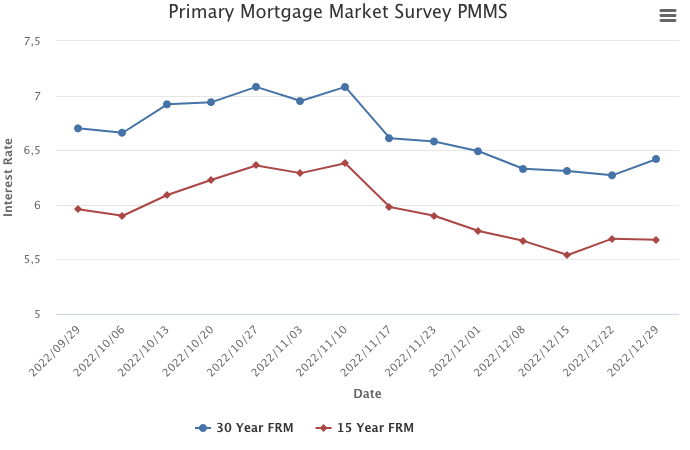

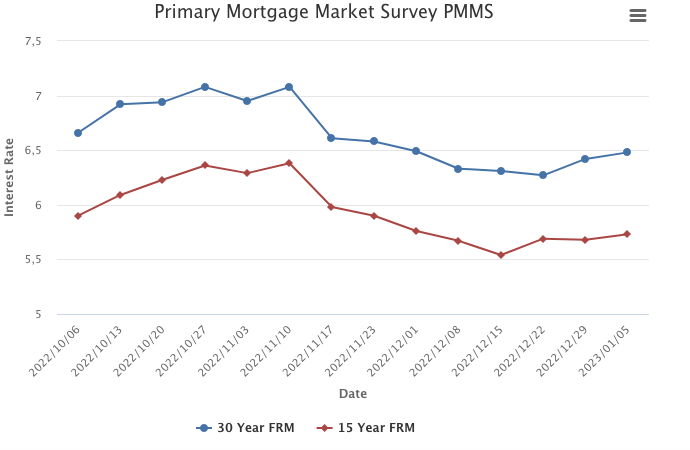

Mortgage application activity sunk to a quarter century low this week as high mortgage rates continue to weaken the housing market. While mortgage market activity has significantly shrunk over the last year, inflationary pressures are easing and should lead to lower mortgage rates in 2023. Homebuyers are waiting for rates to decrease more significantly, and when they do, a strong job market and a large demographic tailwind of Millennial renters will provide support to the purchase market. Moreover, if rates continue to decline, borrowers who purchased in the last year will have opportunities to refinance into lower rates.

Information provided by Freddie Mac.

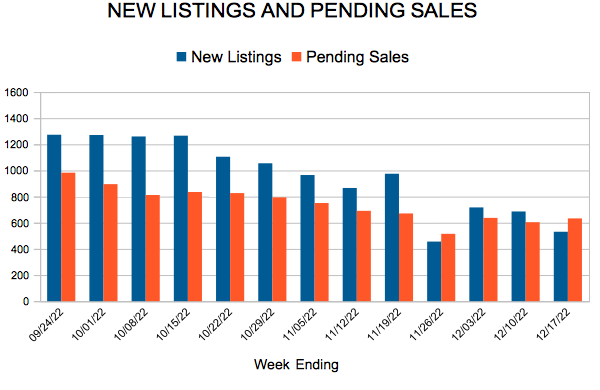

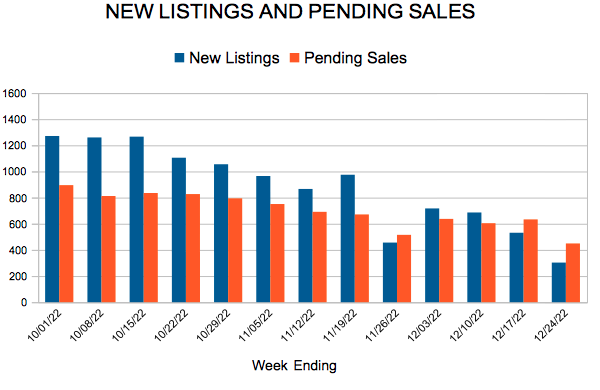

For Week Ending December 24, 2022

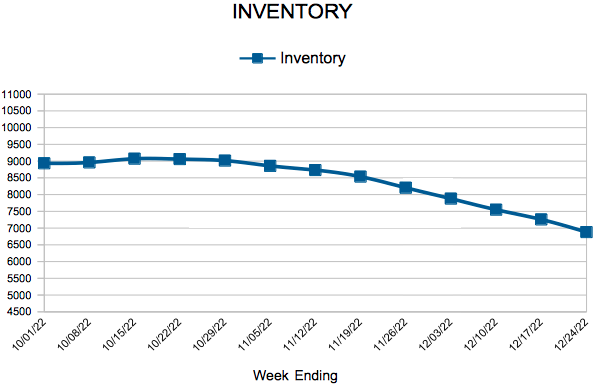

For Week Ending December 24, 2022